The more someone buys, the more your revenue grows. And the more opportunities you give someone to spend money, the more chances you have to grow incremental revenue. In the next part of my series on the The 5 Drivers: The Simple Math at the Core of Your Business, we’re going to look at how to increase the number of customer transactions without them feeling nickel-and-dimed.

1. Make the product or service a subscription.

A lot of products or services benefit from an ongoing schedule. Amazon locked into this early by turning one-off purchases for things like toilet paper or dog food into subscriptions with its Subscribe And Save feature.

2. Ask for referrals.

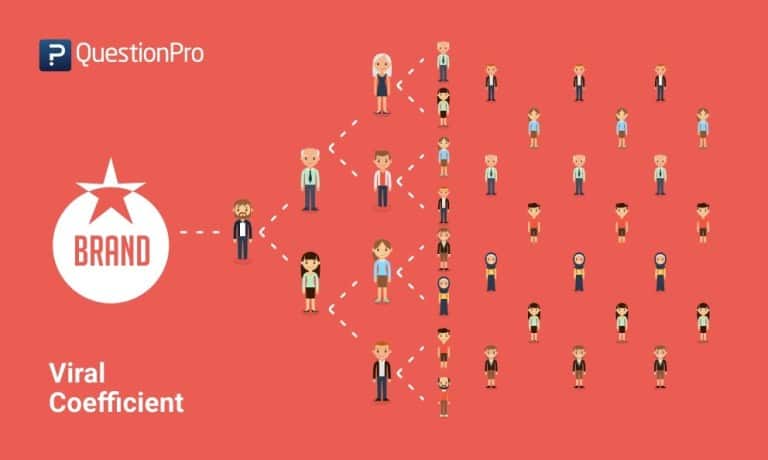

It’s weird how hesitant people are about doing this. If a client or customer has had a good experience with you, they’re likely to do it anyways. By prompting them, they may think of someone to refer sooner rather than later. Referrals are great because you’re creating another transaction for likely the same or similar average dollar sale.

Referrals activate a principle known as the viral coefficient, which basically refers to the number of new customers an existing customer can generate. Aim to get that ratio above 1:1, and your reputation will be growing under its own power.

3. Offer savings or benefits with longer contracts.

Apartment complexes do this very well. Sign a 12-month lease for $X rent, or sign for 15 months and pay $30 less than $X.

4a. Pre-schedule the follow-up.

Just like the dentist office. But “follow-up” can even refer to the next phone call or check-in point. If possible, don’t leave the next touchpoint vague and up to the customer. Get something on the books, even if it has to be rescheduled later. People can be reluctant about pushing appointments that have been sitting on their calendar.

4b. Actively follow up.

If you didn’t or couldn’t pre-schedule a follow-up (maybe it just doesn’t make sense for your business), go ahead and reach out even if it’s been a week, a month or a year. You never know, your follow-up could hit them at just the right time to re-engage with you.

5. Find and focus on segments you know will buy again.

You know those blue plastic swimming pools? Chances are, mom and dad only need to buy maybe one every summer. But guess who buys a ton of them and uses them regularly all year long? Construction companies, which use them to mix cement.

Look for unexpected customers within your sales and you might find opportunities to increase transactions in that area.

6. Create a loyalty program.

I don’t drink coffee, but one of my employees is nearly always holding a Starbucks cup. Even though she knows she spends a lot on coffee, for her, it’s worth it for the rewards the program offers. Rewards programs play on our desire to feel special and valued. How could you reward customers for spending more with you?

7. Try a two-part tariff model.

I have a Costco membership. I pay an annual fee for a membership…which grants me access to the store, where I can buy things at discounted prices. Not only that, but I feel the need to spend enough to justify the membership cost. What a system.

8. Make your platform proprietary and difficult to leave.

Apple. Salesforce. Hubspot. Car manufacturers. Once you’re in with one of these types of businesses, you’re pretty tied to it. Then again, you want to make sure you’re good enough that no one really wants to leave.

9. Plan for regular obsolescence.

Once again, Apple is the king of this. Phones are designed to function optimally for about two years, at which time you need to jump to the next device before yours degrades too much. look at creating a product or service schedule that encourages repeat transaction cycle.

10. Unlock exclusive experiences for repeat customers.

This goes well beyond a loyalty program or subscription. My best example here is Disney. When you buy an annual pass, you get a sticker. That sticker grants you extra special treatment, discounts on food and access to exclusive merchandise. Other park visitors see this special treatment and want it, too. Exclusivity breeds demand.

Like this? Check out the rest of the 5 Drivers Series:

Part 1 – 5 Drivers: The Simple Math at the Core of Your Business

Part 3 – 5 Drivers: Conversion Rate